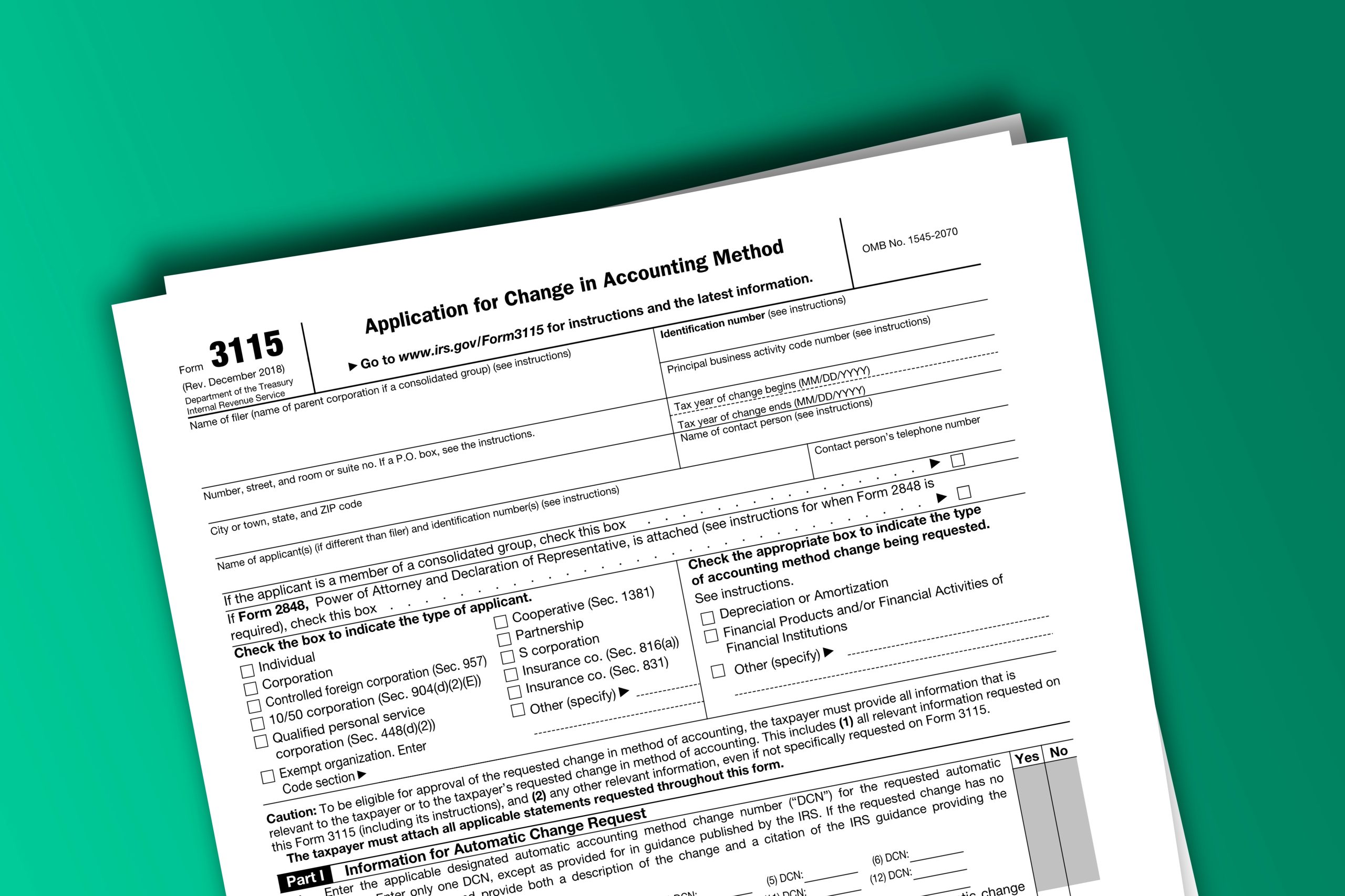

A Form 3115 is called the “Application for Change in Accounting Method.” It is for an automatic change in any method of accounting. A form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method, accelerating depreciation, expensing a previously […]

Read MoreForm 3115 Filing Guide: Complete Instructions for Changing Accounting Methods