The commercial real estate landscape is undergoing a dramatic transformation. At the center of this shift? Data centers, once niche infrastructure assets, now driving billions in investment and reshaping portfolios across the country.

As demand for cloud computing, artificial intelligence, and digital services continues to surge, data center development has become one of the most dynamic segments in commercial real estate. For property owners and investors entering this space, understanding how to optimize returns through strategic tax planning isn’t just beneficial, it’s essential.

Why Data Centers Are Dominating Commercial Real Estate

The numbers tell a compelling story. U.S. data center capacity has expanded rapidly over the past decade, with no signs of slowing. The driving forces are clear:

Explosive Digital Demand

Cloud services, streaming platforms, e-commerce, and emerging technologies like AI require massive computing infrastructure. Every digital interaction, from video calls to online transactions, relies on data centers operating around the clock.

Mission-Critical Infrastructure

Unlike traditional commercial properties, data centers represent critical infrastructure. Downtime isn’t just costly, it’s unacceptable. This creates stable, long-term demand and attractive lease structures for investors.

Institutional Interest

Real estate investment firms and institutional investors have recognized data centers as a distinct asset class offering strong risk-adjusted returns, long-term lease commitments, and resilience even during economic uncertainty.

Geographic Expansion

While traditional tech hubs continue to grow, data center development is expanding into secondary and tertiary markets where land, power availability, and connectivity converge with lower operating costs.

The Investment Upside: Strong Fundamentals and Long-Term Growth

For commercial property owners and developers, data centers offer several compelling advantages:

Predictable Cash Flow

Data centers typically operate under long-term triple-net leases with creditworthy tenants, often major technology companies or cloud service providers. These agreements provide stable, predictable income streams.

High Barriers to Entry

The technical complexity, capital requirements, and infrastructure needed to develop data centers create natural barriers that limit competition and support property values.

Value-Add Opportunities

Upgrading power capacity, enhancing cooling systems, or improving connectivity infrastructure can significantly increase asset value and command premium rents.

Resilient Demand

Digital transformation isn’t slowing down. As businesses continue migrating to the cloud and AI adoption accelerates, the need for data center capacity will only intensify.

But while the operational fundamentals are strong, maximizing returns requires more than selecting the right property. Strategic tax planning can dramatically enhance your bottom line, often delivering immediate cash flow improvements that strengthen overall investment performance.

How Cost Segregation Accelerates Data Center Returns

Data centers represent some of the most capital-intensive commercial real estate investments. Between specialized electrical systems, advanced HVAC and cooling infrastructure, backup power generators, fire suppression systems, and extensive interior buildouts, these facilities contain millions of dollars in depreciable assets.

This is where cost segregation becomes a powerful financial tool.

What Is Cost Segregation?

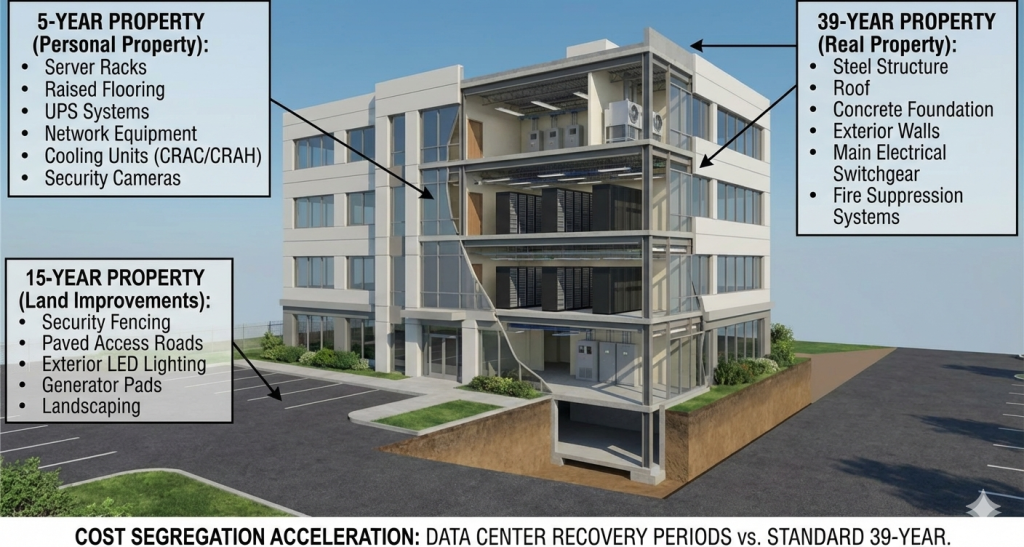

Cost segregation is an engineering-based tax strategy that identifies and reclassifies building components into shorter depreciation categories. Instead of depreciating your entire data center over 39 years, a detailed cost segregation study isolates assets that qualify for 5, 7, or 15-year depreciation schedules, accelerating deductions and improving cash flow.

Why Data Centers Are Ideal Candidates

Data centers are uniquely positioned to benefit from cost segregation due to their complex infrastructure:

Electrical Systems

Redundant power distribution, uninterruptible power supplies (UPS), generators, transformers, and electrical panels often qualify for accelerated depreciation.

Specialized Cooling and HVAC

Precision cooling systems, computer room air conditioning (CRAC) units, and dedicated ventilation infrastructure are critical to operations—and typically eligible for shorter recovery periods.

Fire Suppression and Life Safety

Advanced fire suppression systems, including pre-action sprinklers and gas-based suppression, may qualify for reclassification.

Raised Flooring and Cable Management

Raised access floors, cable trays, and structured cabling systems support operations and often fall into shorter depreciation categories.

Site Improvements

Parking areas, fencing, landscaping, and exterior lighting are frequently reclassified into 15-year property.

The Financial Impact

A properly executed cost segregation study on a data center acquisition or new construction project can reclassify 20% to 40% of the building’s cost basis into accelerated categories. The result is significant upfront tax deductions that increase cash flow in the early years of ownership; cash that can be reinvested, used to pay down debt, or deployed into additional acquisitions.

For a $20 million data center, this could mean hundreds of thousands, or even millions, in additional first-year deductions, depending on the property’s composition and applicable tax provisions.

Timing Matters

Cost segregation can be applied to:

- New construction projects

- Recent acquisitions

- Substantial renovations or expansions

- Properties purchased in prior years (through a look-back study)

The sooner you act, the greater the cash flow benefit.

R&D Tax Credits: An Often-Overlooked Opportunity

While cost segregation addresses the building itself, there’s another tax strategy that data center operators and developers should consider: Research & Development (R&D) tax credits.

When Do R&D Credits Apply?

Not every data center qualifies, but if your operation involves qualifying research activities, the credits can be substantial. Potential scenarios include:

Developing Proprietary Systems or Software

If your team is designing custom infrastructure management software, proprietary cooling algorithms, or energy optimization systems, these activities may qualify.

Innovative Engineering Solutions

Overcoming technical challenges related to power efficiency, thermal management, or system redundancy through experimentation and testing can meet R&D criteria.

Custom Infrastructure Development

Designing and testing novel configurations, backup systems, or integration solutions that go beyond standard industry practice may qualify.

Process Improvements

Developing new methods to improve uptime, reduce energy consumption, or enhance operational efficiency through systematic testing and iteration.

What Qualifies?

The IRS defines qualifying research activities as those that:

- Rely on principles of engineering, computer science, or physical science

- Involve a process of experimentation to eliminate uncertainty

- Aim to develop or improve functionality, performance, reliability, or quality

If your data center operations involve internal teams conducting this type of work; whether in infrastructure design, software development, or systems integration; you may be eligible for significant federal, and potentially state, R&D tax credits.

Combining Strategies for Maximum Impact

For data center owners engaged in both property development and operational innovation, the combination of cost segregation and R&D tax credits can deliver compounding benefits:

- Cost segregation accelerates depreciation on the physical building and infrastructure

- R&D credits offset payroll taxes or income taxes related to qualifying innovation activities

Together, these strategies create a comprehensive tax optimization approach that maximizes cash flow and enhances overall investment returns.

Making the Most of Your Data Center Investment

The data center sector offers exceptional opportunities for commercial real estate investors, but realizing the full potential of these assets requires more than strong operations and reliable tenants. Strategic tax planning plays a critical role in maximizing returns and improving cash flow.

Whether you’ve recently acquired a data center, completed new construction, or are planning a major expansion, now is the time to explore how cost segregation and R&D tax credits can impact your bottom line.

Ready to Calculate Your Potential Savings?

CSSI Services specializes in engineering-based cost segregation studies and R&D tax credit analysis for data centers and other commercial properties. With over 23 years of experience and more than 60,000 completed studies, we bring the technical expertise and tax law knowledge needed to deliver meaningful results while maintaining the highest standards of compliance and defensibility.

Request a free analysis today and discover how much you could save.